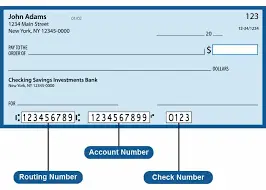

A check routing number is a nine-digit number that is used to identify the financial institution where a check is drawn from. It is located in the bottom left corner of a check, on the line with the words “ABA Routing Number.” The first two digits of the routing number identify the Federal Reserve Bank where the account is held, the next three digits identify the financial institution, and the last four digits identify the specific branch of the financial institution where the account is held.

Here are some tips for finding your check routing number:

- Look at your checks. The routing number is located in the bottom left corner of the check, on the line with the words “ABA Routing Number.”

- Check your online banking account. Most online banking accounts will display your routing number in the account information section.

- Contact your bank. If you cannot find your routing number on your checks or in your online banking account, you can contact your bank and they will be able to provide it to you.

It is important to keep your routing number confidential. Do not share it with anyone you do not trust. If you are concerned about the security of your routing number, you can create a virtual routing number. A virtual routing number is a temporary routing number that is generated by your bank. It can be used for online payments and other transactions where you do not want to share your real routing number.

Here are some tips for protecting your routing number:

- Do not share your routing number with anyone you do not trust.

- Be careful when entering your routing number online or over the phone. Make sure that the website or phone number is secure before entering your information.

- Use a virtual routing number for online payments and other transactions where you do not want to share your real routing number.

By following these tips, you can help to protect your routing number and keep your financial information safe.

FAQs

What is a check routing number?

A check routing number is a nine-digit number that is used to identify the financial institution which a check is drawn from. It is located in the bottom left corner of a check, on the line with the words “ABA Routing Number.” The first two digits of the routing number identify the Federal Reserve Bank where the account is held, the next three digits identify the financial institution, and the last four digits identify the specific branch of the financial institution where the account is held.

Why do I need my check routing number?

You need your check routing number when you need to make an electronic payment to someone who has a bank account. This could include setting up direct deposit for your paycheck, paying a bill, or making a wire transfer.

What happens if I enter the wrong check routing number?

If you enter the wrong check routing number, the payment may be rejected or delayed. In some cases, the payment may even be sent to the wrong account. If this happens, you will need to contact the person or company you sent the payment to and let them know about the mistake. They may be able to cancel the payment and send it again with the correct routing number.

How can I protect my check routing number?

You can protect your check routing number by not sharing it with anyone you do not trust. You should also be careful when entering your routing number online or over the phone. Make sure that the website or phone number is secure before entering your information.